Federated Funding Partners Fundamentals Explained

Table of ContentsThe Best Strategy To Use For Federated Funding Partners LegitFederated Funding Partners Reviews for DummiesThe Facts About Federated Funding Partners Bbb RevealedNot known Facts About Federated Funding PartnersRumored Buzz on Federated Funding Partners Bbb

Permits greater borrowing limitations, fit to consolidate large amounts of bank card financial debt. Normally will supply lower rates of interest than comparable charge card choices. Some financial debt loan consolidation car loans supply alternatives for co-signers, which might permit the far better credit history of the co-signer to make lower rates as well as better terms for the loan.

Drawbacks of a financial debt loan consolidation funding Financial obligation loan consolidation fundings might not have minimum credit scores rating needs but will certainly base their rates of interest and also payment terms on your credit history. When your financial obligation loan consolidation financing transforms your credit report cards back to a no balance, you might be tempted to use that credit history, which can advance your bank card problem.

Build & maintain healthy debt routines You have actually lastly decreased your charge card financial obligation by taking among the choices over. Right here's just how you can keep it that means: Automate your settlements as well as pay your complete balance every month The largest consider your credit history is your background of repayments: maintain them in a timely manner and also you'll see your credit rating slowly build.

Not known Facts About Federated Funding Partners

An unfavorable debt usage proportion can cause your credit rating to drop. Make a month-to-month credit rating evaluation day Planning for the future isn't amazing, but residing in the future with your wealth will be - federated funding partners reviews. Allot one day a month to take out your account statements, bank card declarations, and also credit history report and also analyze your accounts.

With the higher credit history that include financial obligation repayment, you'll begin to earn approval for incentives cards that provide either money back, travel discounts, or gifts. The real sign of fantastic debt is when you invest much less than what you gain.

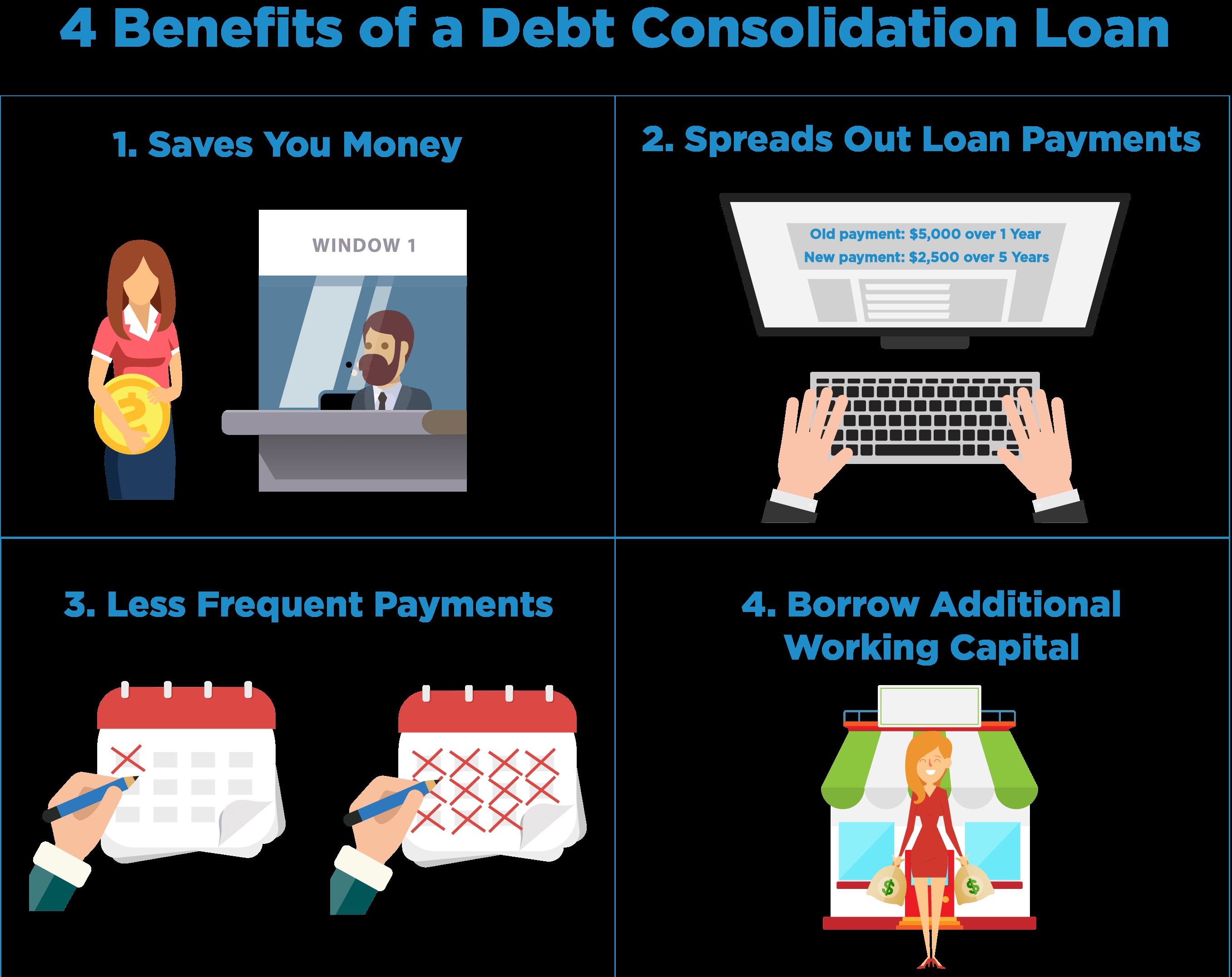

Before proceeding with a financial debt combination lending, it is essential that you recognize all elements of it. Below is a listing of both the advantages and also downsides of financial obligation combination lendings.

Furthermore, with several settlements debtors typically rack up a significant amount of rate of interest when they are incapable to settle each individual financial obligation whereas with a financial obligation loan consolidation funding there is simply one easy repayment, so rates of interest will likely be decreased each month. federated funding partners.: debt combination funding passion rates often tend to be lower than credit scores card rates, so you conserve money as well as pay off your debts quicker.

7 Simple Techniques For Federated Funding Partners Bbb

In fact, given that you have actually reduced your interest settlements, it is feasible that your credit report ranking will in fact improve as an outcome of your brand-new financial obligation consolidation financing. Downsides of a Debt Loan consolidation Lending To receive a financial debt consolidation finance, you may be needed to give some kind of security.

If you are incapable to make your finance payments, you take the chance of losing your vehicle, home, or house items. Even though you might potentially save with a decreased rate of interest, integrating of your old financial obligations into one debt consolidation funding will still leave you with a large regular monthly find out here now settlement. If you had problem making your settlements on 3 or four tiny loans, you may still have.

If you owe greater than you can manage, a debt loan consolidation lending is an option most definitely worth taking into consideration. Keep in mind, however, that you have various other choices as well, such as credit score counseling, a customer proposal, or personal bankruptcy, so we suggest you review every one of your options and also then decide which choice is best for you.

Having a hard time to handle your debt look at this website repayments? Settling your financial obligation can be a terrific means to simplify your finances as well as bring your month-to-month investing under control. However there are several forms of financial obligation loan consolidation and each technique includes specific threats. So before making a Check Out Your URL choice, below are all the important things you need to think about.

The Buzz on Federated Funding Partners

The advantage of debt combination is generally some mix of the following: Fewer regular monthly settlements to manage Reduced total interest fees Smaller overall monthly payment Lower total price to pay off all financial debts Simply put, debt loan consolidation must make your life much easier as well as conserve you money. Obviously, that's not a guarantee.

Here are what may be taken into consideration the six most usual techniques: Unprotected loan consolidation loan You can take out an unsecured financing from your banks of option and make use of the funds to repay your impressive debts. You'll after that be repaying the lending monthly rather of your old debts. House equity car loan If you have equity in your house, you can get a loan versus that equity and also use the funds to repay your financial debts.

Learn much more regarding credit history and also financial debt consolidation: Following actions Any kind of sticking around questions regarding financial obligation loan consolidation? If you have questions regarding debt, credit report, as well as individual expenditures, they have the assistance and sources you require.

Some Of Federated Funding Partners Legit